Important Qualifier before we get started…

I want LNG in America to succeed wildly. I don’t think enough is being done by the United States to utilize its natural resources and promote an energy policy to get this country humming (nuclear energy, oil, LNG, coal, not battery-powered cars, solar panels that are easily destroyed by hail and wind farms that are not efficient or effective.) We are driving our country on 2 out of 8 cylinders. This has been going on for the last 3 decades. Our infrastructure is poor. Our energy policy has been asinine. We don’t have a clear strategy, stated aloud and implemented by true Americans. Not the multinational globalists elite that HATE the United States.

A national conversation about how to supercharge the economy is needed by top leadership, starting with the Oval Office. A true heart-to-heart with Americans is needed. Drive home that we need a firm direction. It is hard to build back the future industrial base without substantially modernizing without a rational conversation had on AI/robotics – especially mention deregulation – do NOT regulate!

If you want only a handful of billionaires running the future technology space, push regulation and ignore those entrepreneurs (without big capital) but with bigger concepts and ideas to be deployed throughout the United States that can remake it.

Lastly, stop making everything political. Stop subsidizing bad policy. Stop thinking its all about an ROI for the short-term.

Long-term thinking and vision is badly (desperately) needed.

It took around 25 years to build the U.S. interstate highway system. (This was done before I was born. We need this kind of plan for a host of interconnected concepts mentioned above.)

When Glenfarne Group Met Alaska LNG

Glenfarne is the Moderna of LNG.

And like Moderna, its history or genesis of deal making includes one Hunter Biden and the Biden clan. One can read and decide on how Metabiota, Gingko Bioworks, DARPA, the NIH and Bill Gates tie back to what became the COVID-19 engineered virus and Vaccine production. 2nd article.

Brendan Duval, CEO of Glenfarne, the primary ownership company of Alaska LNG

Former Macquarie Group I-banker of 15+ years. Likely knows Albert Tse (Macquarie Asia/PM Rudd former son-in-law). Tse, who Hunter Biden & Devon Archer met in Beijing in 2011, discussed deals with Jonathan Li, a chief Chinese business partner of Biden. [Li would send the Bidens a $250,000 check in 2019 according to the U.S. House investigations.]

Duval started up Glenfarne (in 2015) with around 50M in capital. Thereafter, bought up distressed S. America “green assets.” Early deals were in solar and wind in Central and South America. Worked with Milbank and Natixis.

July 2018: Used French Investment bank Natixis along Sumitomo Mitsui Banking and Apollo to provide $700M towards green projects. [WSJ]

April 2019 and May 2020: Acquired rights of control to Texas LNG from billionaire Daniel Loeb at Third Point and Magnolia LNG from First Wall Street Capital for $2M.

Thereafter, Duval and Glenfarne was highly active with lobbying Biden administration officials (visit with German Ambassador), 2 U.S. Senators (Bill Cassidy & Joe Manchin) along with Secretary of State Tony Blinken visiting with Glenfarne subsidiary head at Enfragen-Prima Energia-Fontus in South America.

January 2025: Glenfarne revealed as the primary developer and 75% owner of Alaska LNG, forming Glenfarne Alaska LNG LLC.

The Alaska LNG project is being jointly developed by Glenfarne and the Alaska Gasline Development Corporation. It includes construction of an 807-mile, 42-inch pipeline to carry natural gas from the North Slope to a planned export facility in Nikiski on the Kenai Peninsula. A final investment decision for the in-state pipeline segment is expected in the fourth quarter of 2025. [ My emphasis.]

2017

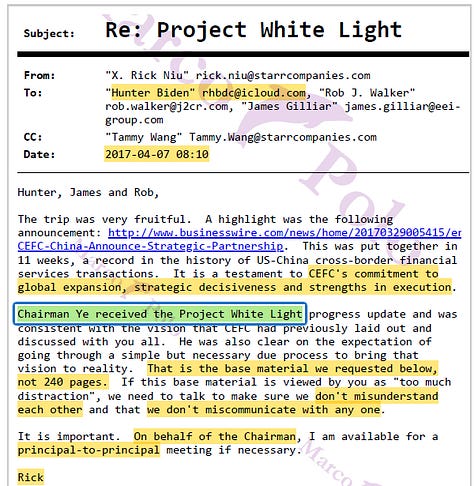

Once Joe Biden left the Vice President office, Hunter was off and running towards doing deals with the biggest belt-n-road player in CEFC. In February 2017, just 3 weeks after Joe left office, Hunter met Ye Jianming in Miami at a boat show. The goal was to kickstart a major partnership across the world to fill both Hunter’s pockets (10% for the big guy) and China’s natural resource coffers with the world’s most precious assets imaginable.

A key player to all these machinates: Xiaopeng ‘Rick’ Niu. [Misspelled below.]

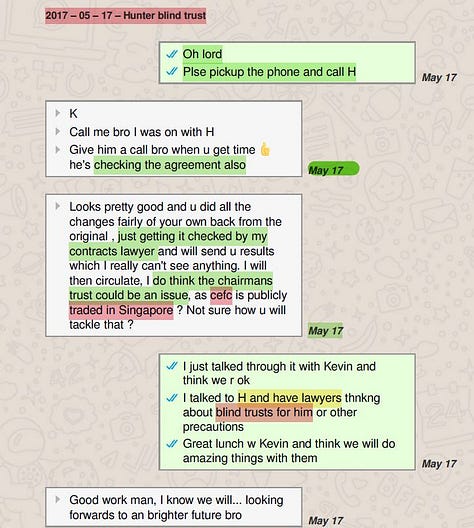

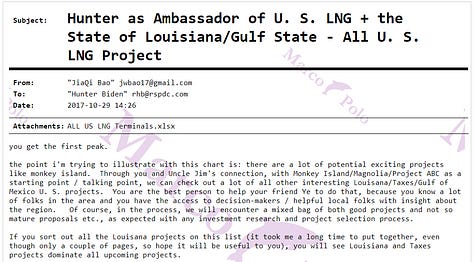

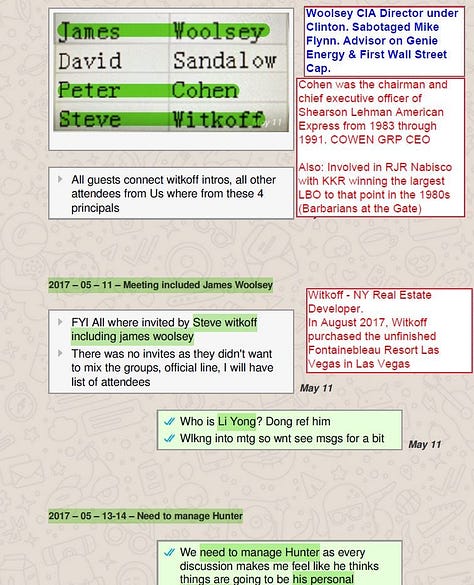

Evidence of Blind Trust, Contact Xiaopeng Rick Niu, CEFC’s interests in U.S. LNG Assets & Steven Witkoff & R. James Woolsey & $5M into Hudson West

Hunter and James Biden cut would be partners Tony Bobulinski, James Gilliar and close friend Rob Walker out of the deal by July 2017, preferring to do their own deal vetting through a host of shady lawyers in the rolodex of the Bidens.

Robinson Walker (above). Worked with Hunter Biden from late 1990s while in Clinton admin. Wife worked directly for Jill Biden. Partnered with Hunter on pre-CEFC deals. Receive $3M from CEFC-affiliated company State Energy HK, based in Hong Kong (Feb-Mar 2017). Deposition of Walker mentioned Louis Freeh (assisting) with Eastern European corruption matters (through US State Department).

Some earlier information gathered on the genesis of Hudson West - CEFC partnership:

By 2017’s end, the Bidens were spooked off the deals with CEFC due to Patrick Ho’s arrest. Within 4 months, Ye Jianming would disappear.

Bhaswar ‘Joy’ Chatterjee (far above). Recommended by JiaQi Bao. New York City based – close geographic vicinity to FWSC, FSS, Glenfarne. Natixis advised on a $700M debt finance deal ($400M coming in from Natixis/Sumitomo Mitsui) to Glenfarne subsidiary (EnfraGen) in July 2018. EnfraGen Capital formed in November 2017, within a day of FBI’s arrest of CEFC’s Patrick Ho [no pic]. Hunter represented Ho for $1M. [ Politico published the 51 Intel Agents on October 19th.]

Ye Jiaming. CEO of CEFC. Met Hunter Biden in February 2017 in Miami. Later met Joe Biden (according to deposition by Tony Bobulinski) in New York City. His underling, Patrick Ho, arrested in November 2017 & found guilty in SD of NY. Chairman Ye fell out of favor; lost his company; and disappeared in March 2018. CEFC ranked 229th on the Global 500 in 2016 with $43 Billion (US) in Revenues.

2018 - Girls Girls Girls & Money Gone

Hunter went on a spending binge, predominately on call girls when not also throwing tantrums about his partners, his assistant, and their dealings.

Source: https://thenationalpulse.com/archive-post/biden-recording-spy-chief-and-sdny/

My August 2024 analysis of the Biden Grift: https://rumble.com/v5cagut-chasing-the-grift-a-hunter-biden-laptop-feature-film.html

2019 - Texas LNG from a Billionaire

Glenfarne get its first LNG project with long time email buddy of Hunter Biden, Daniel Loeb of Third Point. A change of control was issued in April 2019. By years end, Glenfarne does some financial readjustments through its South America operations, hitting up Scotia Bank and Davivienda for new structuring of financing.

Dan Loeb. Billionaire & CEO of Third Point LLC. Bought Texas LNG in 2014. His underlings told Hunter Biden about Texas via email around time of purchase. Hunter, Loeb & his COO were in email contact from 2010-2016. Several times meeting for lunch in NYC. Third Point was previously located at 390 Park Avenue. Right across the street from First Wall Street Capital (FWSC) and Magnolia LNG’s prior financier.

2020 - Magnolia LNG & Time Magazine

Time Magazine mentions William ‘Mardsen’ Miller but never links him back to Hunter Biden. By this time, the laptop was in the possession of the FBI for nearly 1 year. Miller as Time put it:

“The man listed as its co-founder and director, Marsden Miller, is related to [Robert] Bensh by marriage. In 1987, a jury in Louisiana found Miller guilty of corruption; his sentence was later overturned, and the government dropped the case against him after the U.S. Supreme Court narrowed the relevant statute in an unrelated case. LNGE owns no gas fields, no pipelines, no tankers and no export terminal. But its executives had connections in Ukraine and at the Energy Department. On July 10, 2019, those connections began to bear fruit.”

Miller would putting in a winning bid on Magnolia LNG.

Hunter though was well aware of Miller from two of Hunter’s associations: Paul Rowan and Hunter Johnston, the son of former U.S. Senator Bennett Johnston [LA], who Senator Joe Biden served alongside for 25 years. Both Miller and Johnston Louisiana connections in the 1980s puts this in perspective.

Charles Aster (far above). Senior Advisor at 1st Wall Street Capital. Partner, Kane Russell Coleman & Logan. Kane Russell provided legal services for Miller’s Global Energy Megatrend – LNG startup incorporated in UK in September 2019.

William ‘Mardsen’ Miller (near above). Louisiana-based entrepreneur. CEO of now defunct Global Energy Megatrend. Placed a $2.25M winning bid for Magnolia, April 2020. Then backed out. Knows Hunter Biden thru February 2014 emails: Oregon LNG, Fosun Pharma & Chinese investments

Time Magazine Snippet

First Wall Street Capital was not merely a random financier for Magnolia. Their chief advisors included R. James Woolsey (CIA Director), who was mentioned in 2017 texts, and federal judge Eugene Sullivan [no longer pictured], who was included alongside Louis Freeh (FBI Director) in Hunter’s 2016 emails. Freeh kicked $100,000 to the Beau Biden foundation.

Lastly, First Wall Street Capital and Starr Insurance shared the same office space during this deal making. Glenn Myles is also an advisor to CV Starr, headed by Maurice Greenberg, formerly of AIG.

Glenfarne eventually secured the deal on Magnolia LNG. And within months had put in SEC paperwork to create a SPAC IPO.

Part II will examine 2021-2024 activities which are more complex and introduce new players.

References

Thank you Jason. INteresting on the same day 2 articles about LNG, which should overlap at some point, yours and George's:

https://georgewebb.substack.com/p/state-sponsorship-the-next-best-thing

and I do not see the cross-section..;( Sorry, must be missing something. ALso when you look at:

https://www.usimportdata.com/blogs/us-lng-exports-by-country-top-exporters

or

https://www.fool.com/investing/stock-market/market-sectors/energy/liquefied-natural-gas-stocks/

or

https://energydigital.com/top10/top-10-lng-companies

there is nowhere Alaska LNG to find... Maybe too small?

Anyway, cars run on LNG are amazing, have a great cost-friendly mileage.