It helps when bread crumbs like a laptop provide a list of contacts and a keyword search that is readily at one’s fingertips. This provides all the necessary information to build a profile on the person one is examining. Locations, industries discussed, names of entities, people interacted with regularly (or not), banks and law firms generate plenty of ways to see the crime. People may call them, “investment deals,” but when one is using their connections to sell out the country one loves to our greatest adversary: one calls them crimes. Such crimes need necessary connections - as mentioned - to get them done without anyone being the wiser. Hunter though was not wise; his Miami trip to visit Chairman Ye provided a KEY location and from there (and with insider information) it was easy to put locations, people, banks & law firms all together.

RUMBLE ANALYSIS of the ENTIRE NETWORK (Hong Kong and New York)

Location, Location, Location.

Hunter has favorite spots in the United States. Boston, the D.C. area and San Francisco come to mind. His movements obviously surrounded his Rosemont Seneca Partnership in D.C. where Northern VA and Maryland areas are fully Democrat-controlled. This provided him a home base and access to all the lawyers and Agency people needed to get things done.

So it was unusual to see that his activities moved south to Miami and Houston. But that behavior made sense when one saw again the August 2, 2017 BIG GUY pitch by Mervyn Yan and Hunter’s response to it:

My Understanding is that the original agreement with the Director was for consulting fees based on introductions alone a rate of $10M per year for a three year guarantee total of $30M. The chairman changed that deal after we me[t] in MIAMI TO A MUCH MORE LASTING AND LUCRATIVE ARRANGEMENT to create a holding company 50% percent owned by ME and 50% owned by him. [My emphasis.]

MIAMI. Holding company.

But this was sent in August of 2017. How could it be relevant to 2023?

The deal Yan discussed provided it:

1. Regional focus shall be in US, Middl[e] East, Russian, Europe and South America countries, in energy, infrastructures, finance and high-tech sectors.

2. The goal is to source and secure 1-3 deals a year and aims to have 5 more more deals in the pipeline.

Hunter was being asked to “work” for his $10 million for 3 years. If one figures his contributions in 2018 and 2019 were a bust on the deal front after the F***ing spy chief was nabbed, and his partner, Devon Archer, was in custody, then Hunter needed to provide the services demanded by the CCP cronies. That $30,000,000 required a plan.

People

Hunter was provided a sly and sultry CCP assistant that used her connections to grease the deal skis. She pitched towards the Magnolia LNG deal in late 2017. Thereafter, her key insights came out of two emails sent in January 2018:

I have built a few professional and personal connections whom I felt might be helpful for us to talk to for potential deals/ideas for Hudson West. For instance, my family friend David Eldon, chairman of HSBC Middle East and board of director of Noble Group might be a person I think would worth your time to talk to. Besides explore possibility for business collaboration, he might be a good conservationist with interesting ideas that might benefit our business. Same thing with a couple of my other contacts in the energy sector, such as Joy Bhaswar of Natixis + my other Natixis contacts and friends. [My emphasis.]

Two weeks later, JiaQi Bao again led Hunter to the CCP’s desires:

we should dig further with LNG deals + Noble and Natixis (as I mentioned to you that I briefly mentioned to Kevin and Mervyn about my Noble and Natixis connection before, I think we have greater chance to make progress, or at least worth your time to talk to these folks)

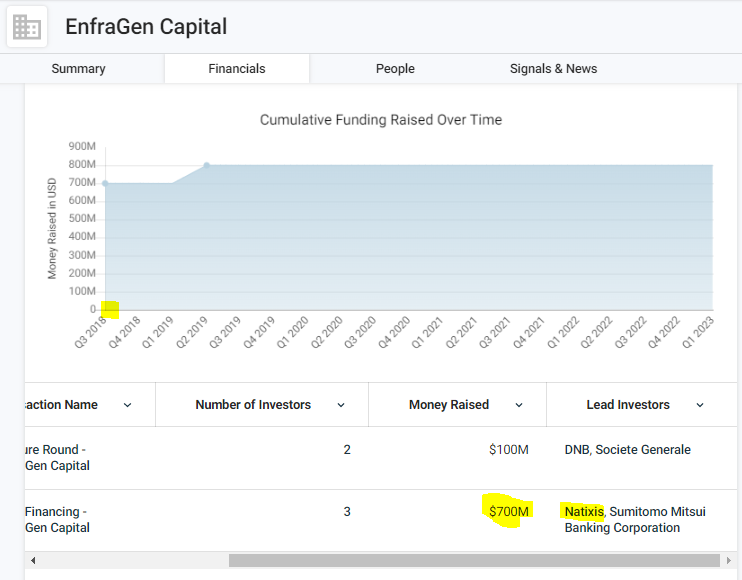

Just six months later, EnfraGen Capital (a subsidiary of Glenfarne Group) had Natixis and Sumitomo Mitsui (with Apollo) supplying $700,000,000 in debt financing.

Banks and Law firms

Glenfarne Group bought two LNG (Magnolia as JaiQi desired in November 2017) projects for a proverbial song in late May 2020: a $2 million deal. February 17, 2021, just 4 weeks after Joe Biden took the oath of office, Glenfarne got busy with their SEC filings necessary to make this deal go ahead - incorporation, stock creation, and an IPO on the NASDAQ in 2022. (Dissolved - March 2023 provides the next date.)

The banking firmed up through Brendan Duval’s EnfraGen Capital raise and his restructuring later. Natixis, a French bank, has a Houston, Texas office. In late 2019, EnfraGen restructured their refinancing to include two key banks: Scotiabank & Davivienda (International). Scotia [misspelled below] is located in both Houston and Miami. Davivienda has a Miami location nearby the Chilean Consulate (EnfraGen does projects in Chile).

The law firms are in the SEC filings: Greenburg, White & Case, and K&L Gates is the lobbying firm for Magnolia, Macquarie Group and Glenfarne.

Additionally, Wells Fargo is right next to Greenberg Traurig LLP, like in one’s backyard. Greenberg was tied to the stock warrants and a blind trust of 22.5% that goes through Continental. Wells Fargo was Hunter and Jim Biden’s Bank of choice from the Laptop from Hell.

The Glenfarne SEC filings alongside a host of fortuitous coincidences regarding locations and other people (CIA, Black & Veatch) make it very hard to not see a reason to dig in LEGALLY on these very tightly woven events.

Is it Hunter (or the CCP) that owns the controlling stake in two U.S. LNG projects?

Something tells me, one will get their BURN NOTICE before HUNTER does.

Related Hunter Biden

Hunter’s Connections to Intel regarding Magnolia LNG

I hope that Jia Qi Bao's "Kevin" did not have a surname McCarthy; if you can follow the documents it would be most reassuring to note the names of the players referenced.

We are looking at a seven-dimensional chess match with, at best, a two dimensional ViewMaster(tm).

And yet, the top brains at the FBI for two years couldn't connect one dot in any of the info on that laptop?