Gunvor Group Meet Glenfarne Group: Hunter Biden & Singaporean Connections

When something smells off - ask questions. Follow the money & the LLCs.

Starting in 2017, Hunter Biden’s deals moved from the friendly confines of Ukraine and Eastern Europe to more exotic and off-the-radar locales. A February 2017 Miami, Florida meeting with Chinese billionaire and CEO of CEFC Ye Jianming kick-offed the money (or diamond flow). This came after a feeling-out period spanning late 2015 through to the dying embers of Obama-Biden’s corrupt administration where Hunter and friends had dreams of lots of money.

Hunter’s friends and associates, Rob Walker, James Gilliar, Eric Schwerin and lesser known names, Michael Karloutsos, were chasing liquefied natural gas deals and “their cut” from them. Seeing how Hunter’s connection to Ukraine’s Burisma Board put them into key investment and middle-man positions. This was ideal for all.

Hunter’s Rosemont business partner, Devon Archer, came to the Burisma Board in April 2014. Devon was much more the brains and knowledge base for their deals – even endorsed by Glenn Myles, a private financier of infrastructure (Magnolia LNG) and Facebook friend of X. Rick Niu, CEFC deal coordinator for Beijing regarding Hunter.

Ukraine’s plentiful resources and Moscow energy orbit was too irresistible to pass up. However, the world of LNG and World Energy plays are driven by market manipulations that sometimes reveal the larger game afoot for the stupidest and greediest suspects.

As we have noted (here, here, here), Hunter’s game involves U.S. LNG projects: Texas LNG and Magnolia LNG. These projects are still very hot – and moving forward under Glenfarne Energy Transition’s ownership. Both LNG projects were key CEFC’s targets – through their associate JaiQi Bao’s emails to Hunter – and both were acquired out of New York City-based entities, located just blocks from Glenfarne’s HQ on Madison Avenue (see below).

Texas LNG 2024 deals with EQT (largest U.S. LNG production mover) and Gunvor Group (a $150 billion per year commodities trader) are moving along nicely even against President Biden’s January EO to stall LNG export projects under further environmental review. (Which can be nixed by national security emergency orders through Joe Biden.)

So how does Singapore factor in here?

Singapore

Gunvor’s March 2024 deal with Texas LNG comes through their Singaporean offices. Gunvor’s overseas offices conveniently overlaps with a host of usual suspects tied to Hunter Biden’s CEFC-related emails – Noble Group, Trescorp Alliance, Natixis, HSBC, Starr Companies – located within a lunchtime stroll in downtown Singapore.

Those specific entities are tied to James Gilliar, Tony Bobulinski, Hamood al-Hashmi, Nigel Robinson, JaiQi Bao, Gongwen Dong, Xiaopeng “Rick” Niu and their CEFC dealings by May 2017. Rob Walker had $3,000,000 pumped through his LLC accounts via a Hong Kong Energy cutout of CEFC in March 2017. Such wasn’t done without something needed in return for those timely and later, Biden-shared deposits. $6,000,000 later came into Hunter’s Hudson West III accounts from August 2017 through March 2018.

Gunvor has an interesting history. Gunvor Group was co-founded by Russian Oligarch, Gennady Nikolayevich Timchenko, who allegedly sold his entire ownership in March 2014 due to his being placed on the U.S. sanctions list due to Ukraine-Russia confrontation. Tellingly, in terms of later targeting, Gunvor settled a $661,000,00 criminal fine with Biden’s DOJ on Friday, March 1, 2024, tied to committing fraud through bribery and money laundering through the usual locations, including: Panama, Caymans and Singapore (FBI Special Agent Jeffrey Veltri noted).

Over nearly a decade, Gunvor representatives bribed high-level government officials at Ecuador’s state-owned oil company to enter into business transactions with other state-owned entities that ultimately benefited Gunvor. As a result of this complex bribery scheme, Gunvor obtained hundreds of millions of dollars in illicit profits.

Gunvor’s case involved a “18-karat gold Patek Philippe wristwatch” bribe – sound familiar? – to woo Petroecuador to do oil deals with the criminal Gunvor traders. Less than 3 weeks later (March 18th), Glenfarne hops into bed with Gunvor Group. (Noble Group – above – was also involved in shady accounting operations, and split apart into two companies.)

The Singaporean BLACK DALI?

About a week after Glenfarne-Gunvor deal, the MV DALI hits the Francis Scott Key Bridge, destroying it. The amount of dollars needed to fix that destruction will run into the billions.

It just so happened that Baltimore had a FERC-approved LNG project (Sparrows Point) nixed back in 2013, located right next door to Francis Scott Key Bridge. Hunter was kicking the tires (in March 2010) on getting in on Baltimore’s LNG action.

This proves that Hunter was LNG-obsessed long before he took a nickel from those corrupt, Nazi-loving Ukrainians. Hunter ran with the D.C. crowd (Pelosi’s son), being “all in” on energy hustles. Paul Pelosi Jr. NRGLAB/Viscoil Holdings (CA #200930910003) worked with Ukrainians; managed by Moscow agents; with a Singaporean HQ for NRGLab.

The MV DALI is owned out of Singapore, though it is unclear who actually owns its subsidiary (Grace Ocean Investment Ltd) and whether it is even out of Singapore, Hong Kong (through BW GROUP), the Caymans, or another favorable jurisdiction to house shell companies like Cyprus.

For the right amount of dollars, one can track that down – whether the Caymans – the whole bit – however, these are not entities that want to be transparent; and likely have a trigger mechanism for people that are a bit too curious. (Look what Hunter’s lawyers are now doing to anyone that touched the laptop, especially Marco Polo. Suing people and pressuring banks to close their accounts. (Donate to Marco Polo.) I expect these folks might do me differently, if these stories get any national traction.)

Even the vaunted New York Times, owned by billionaires and AUM behemoths like BlackRock, don’t seem completely capable of finding the ownership of the MV DALI:

The extremely opaque nature of global ship-owning makes finding the ultimate owners and holding them accountable for any violations difficult. According to Singapore company records, Grace Ocean is owned by the British Virgin Islands-based Grace Ocean Investment Limited. Lloyds List, which first reported Grace Ocean’s infractions in 2021, reported that Grace Ocean Investment is based in Hong Kong. But the company matching the name and address in Lloyd’s database dissolved in 2015, according to Hong Kong company records.

The Singapore company has four directors — two Filipino citizens, a Singaporean and a Japanese person — with all listing addresses in Singapore, records show.

Alexandra Wrage, the president and founder of Trace, a group focused on anti-bribery, compliance and good governance, said that ship ownership structures are designed to maximize opacity and minimize accountability.

[My emphasis.]

The Caymans

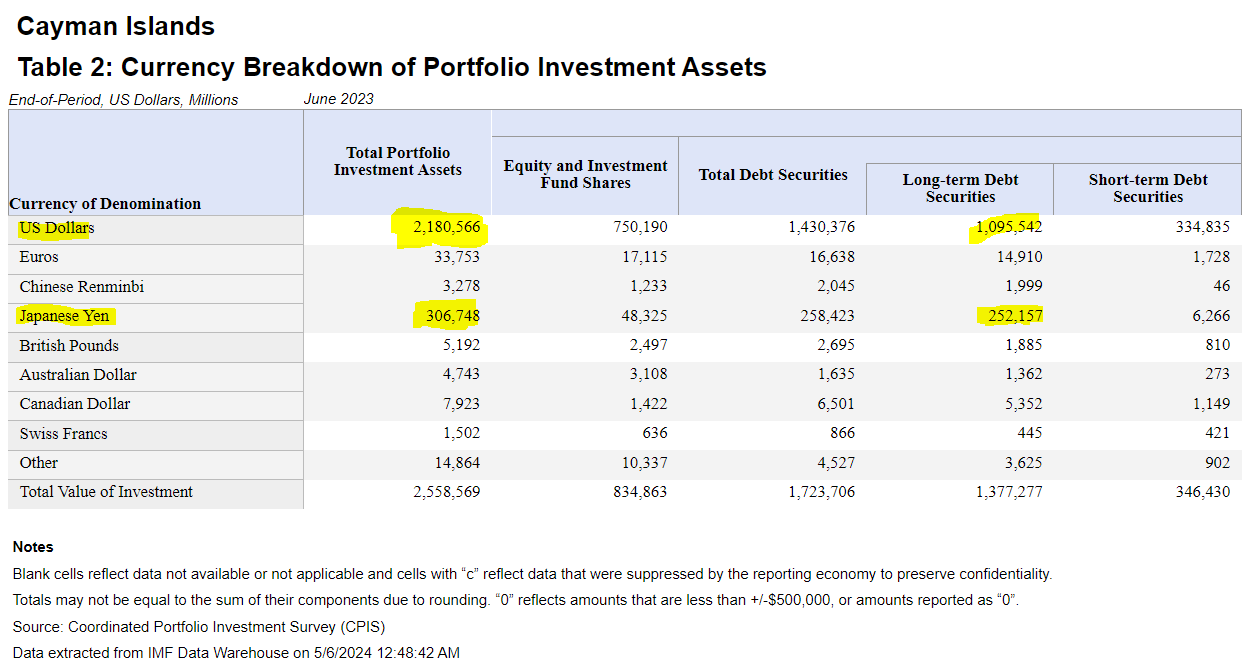

Singapore, Caymans, British Virgin Islands, and Cyprus are notorious places for running ill-got gains, guns, drugs, and making corporate shell companies to route the transactions. Netherlands, Ireland, Japan and Hong Kong make the list too. For perspective the IMF notes, tellingly, shows trillions held in the Caymans ($2.5T), a geographic location of around 100 square miles in total.

Linkages one is looking into are:

Gunvor has Singaporean and Cayman connections. HQ is in Switzerland.

Glenfarne operates its financials through JP Morgan Chase, French, Japanese, and a suite of South American based deposit banks. Partners Group – 50% owner of Glenfarne subsidiary (EnfraGen LLC) – is a Swiss HQ operation.

The ownership of the DALI has opaque Cayman or Singapore locations. But one gal noted above it is own through European oligarchic interests (BW GROUP) and the “Sohmen Family Foundation (the “Foundation”) is a foundation organized under the laws of Liechtenstein.”

Who is going to pay for the DALI’s accident? Where is that money going? Is it headed offshore too? Or coming onshore from Singapore?

Texas LNG is running towards its full operation as it puts all its partnerships in place.

Just in time to make dollars for Glenfarne’s ownership – which were by late 2022 held by a host of Bermuda, Canadian or Cayman-connected investors and 22.5% by Glenfarne Sponsor, LLC, the most opaque of them all.

Interesting....the rot goes deep and wide!