BIDEN SPAC: Singapore's Generation Asia Routes back Export LNG owner Glenfarne Group

Finance never changes. Just new ways to do deals on the sly.

The Big Short for the Big Guy

The Big Guy aka Joe Biden is living on borrowed political time. He’s getting help now from the smartest guy he knows: Hunter Biden. So we know how that all will work out - if past is prologue. The compromised Bidens, by so many countries and scumbag people of known and unknown affiliations, leaves these United States in a quagmire while the Bidens are hanging on to their (dwindling) political power and zero moral authority. One can see the DNC’s desperate attempts to keep him marginally relevant while also pulling Joe, Jill and Hunter out of the picture (politically forever).

[Note: This past weekend’s attempt on Trump’s life reflect conditions were set for an easy take out of the 45th President of the United States.]

One of the “bright” spots of Joe’s ill-gotten power, if you are a Biden clan member, is the ability to grift BIG. Since taking the oath to serve as President (dutifully of course to the Globalist destructive 2030 Agenda), the dementia patient-in-chief undoubtedly increased these grifts in both size and scope.

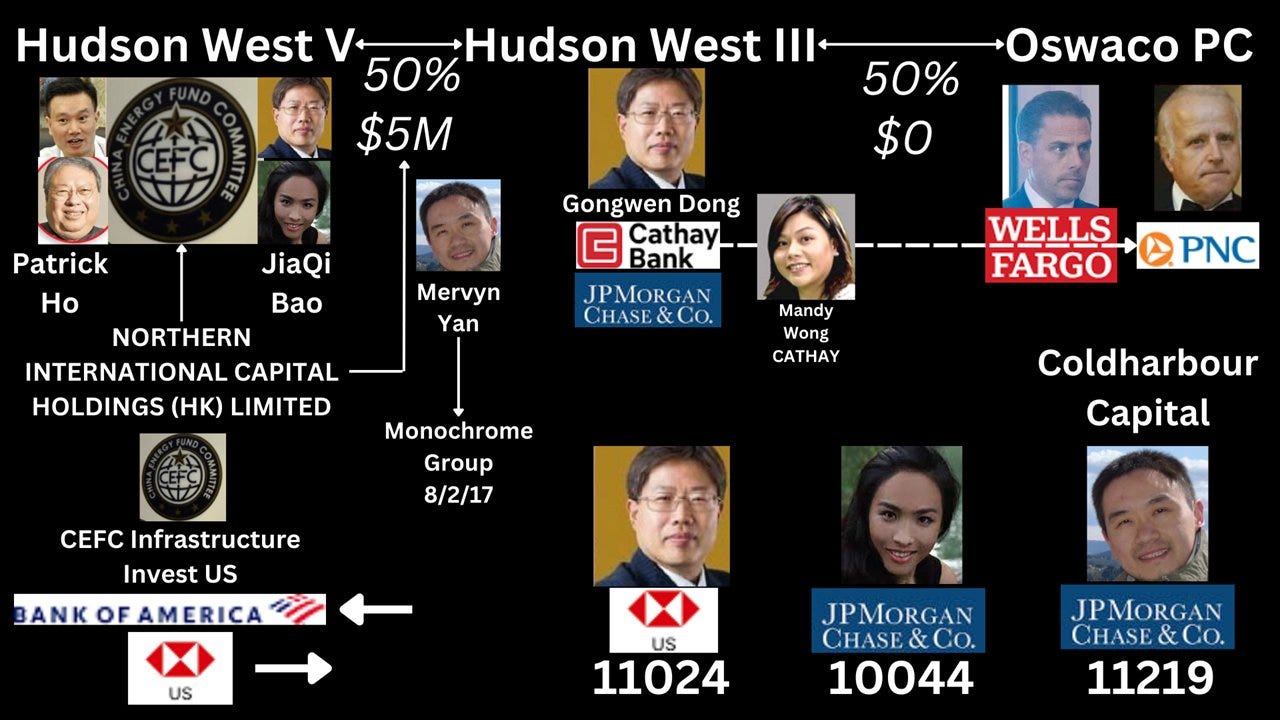

For a baseline example, just 3 weeks after Joe left the Vice Presidency in 2017, his son, Hunter, headed to Miami to meet with CEFC’s billionaire CEO Ye Jianming to garner a $10 million per year grift, running for at least 3 years. (Jim and Sara Biden got a piece of the action there, receiving Cathay Bank credit cards through the CEFC Hudson West partnership deal.)

The 5 digit ZIP Codes of various Hudson West III parties

Just over a year later, in March 2018, Chairman Ye disappeared from the business world. Never to be seen again. It is July 2024 - Joe Biden is President, his counterpart, Xi Jinping, is Paramount Leader, and the topic of Hunter Biden’s former partner never gets mentioned at all by those noxious media minions that downplayed the Trump assassination attempt instantaneously.

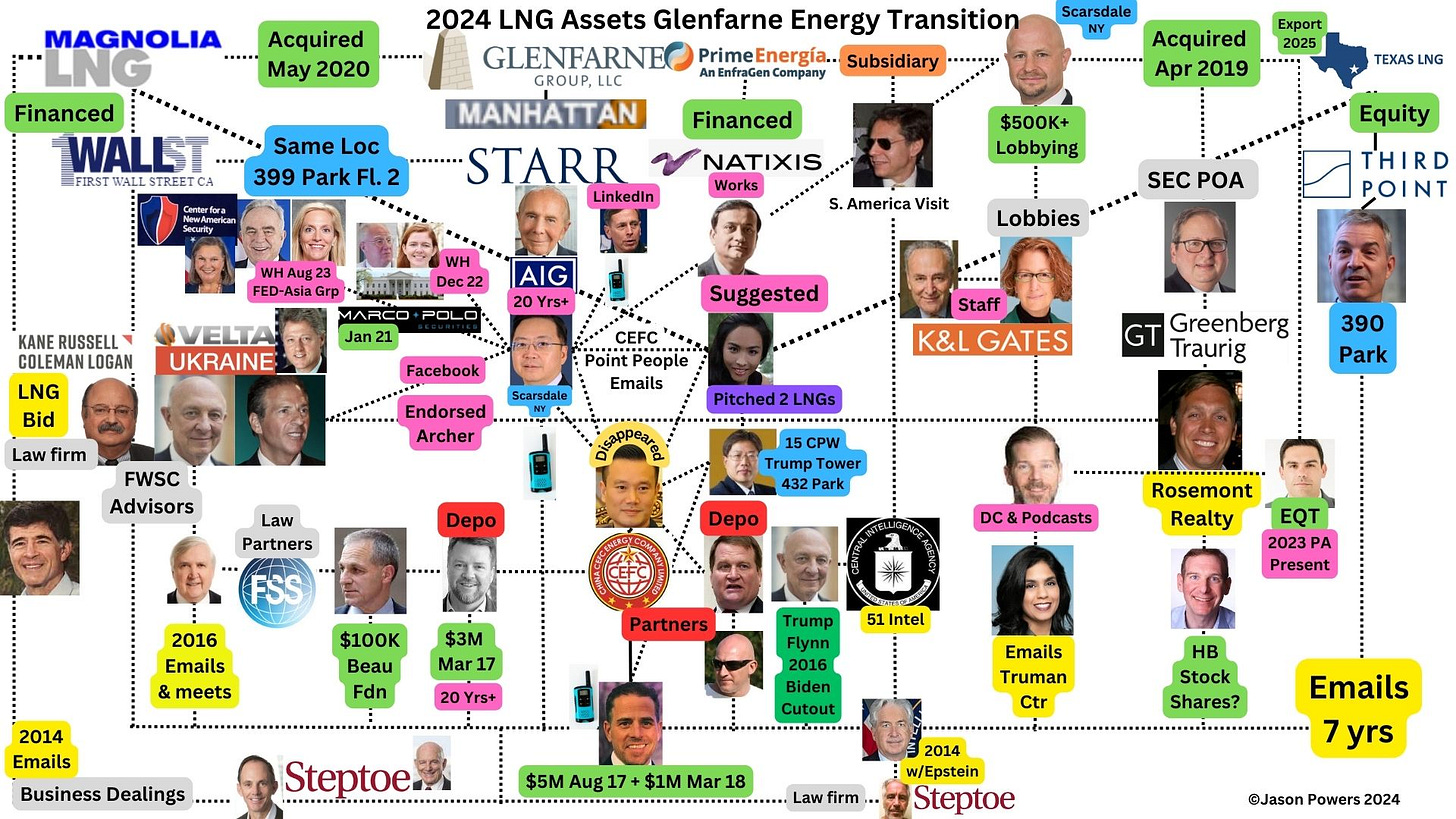

One thing however did occur: two LNG infrastructure deals kicked about by Ye’s underlings from Kevin Gonwen Dong to JiaQi Bao to slick ‘Rick’ Niu were massaged into the appropriate hands. One has discussed this voluminously - as the pieces to the puzzle (all connected to Hunter from real estate, law firms, to finance, to prior owners, to top U.S. intel directors) fell neatly into place. This many connections (below) is not by mere chance - it is project management for a much bigger payoff & the Biden clan retirement purposes, one conjectures.

The SPAC (Special Purpose Acquisition Company)

I am not an expert on these entities, but this is how Hunter (& the Biden clan) are hiding their presence with respect to their LNG ownership one contends. But to understand this, we will start off with Michael Milken (who has an ancillary connection to the prior financier of Magnolia LNG.)

Forbes published a piece titled: “From Junk Bond King To SPAC Whale: How Michael Milken Became A Big Investor In The SPAC Boom” in May 2021. Antoine Gara wrote:

…the SPAC bubble that overwhelmed U.S. financial markets in 2020 and early 2021, few investments would illustrate the mania better than a vehicle known as Churchill Capital IV.

Listed on the New York Stock Exchange in September 2020 after a $2.1 billion initial public offering, Churchill quickly became one of the hottest SPACs on the market. From January to mid-February 2021, Churchill rose 550% to a $15 billion market capitalization as novice traders on trading apps like Robinhood fervently bid the shell company to the moon in anticipation of its merger with an electric vehicle startup called Lucid Motors. Then, like so many SPACs, after the bubble was pricked by the Securities and Exchange Commission’s scrutiny and a retreat of speculators, Churchill came crashing down to earth, falling by two-thirds in value over the past three months.

While many investors were likely burned by Churchill’s roller-coaster ride, one Wall Street legend appears to have made a haul. Billionaire philanthropist and financier Michael Milken, once known as the Street’s junk bond king for pioneering the issuance of high yield bonds to finance leveraged takeovers in the 1980s at Drexel Burnham Lambert, profited from Churchill’s ascent.

This operates as another investment vehicle to do market manipulations to achieve riches with the loose monies that float around the world daily.

A theory of mine goes: It takes money to make even more money (but you don’t have to have a business proposal that actually works at all.)

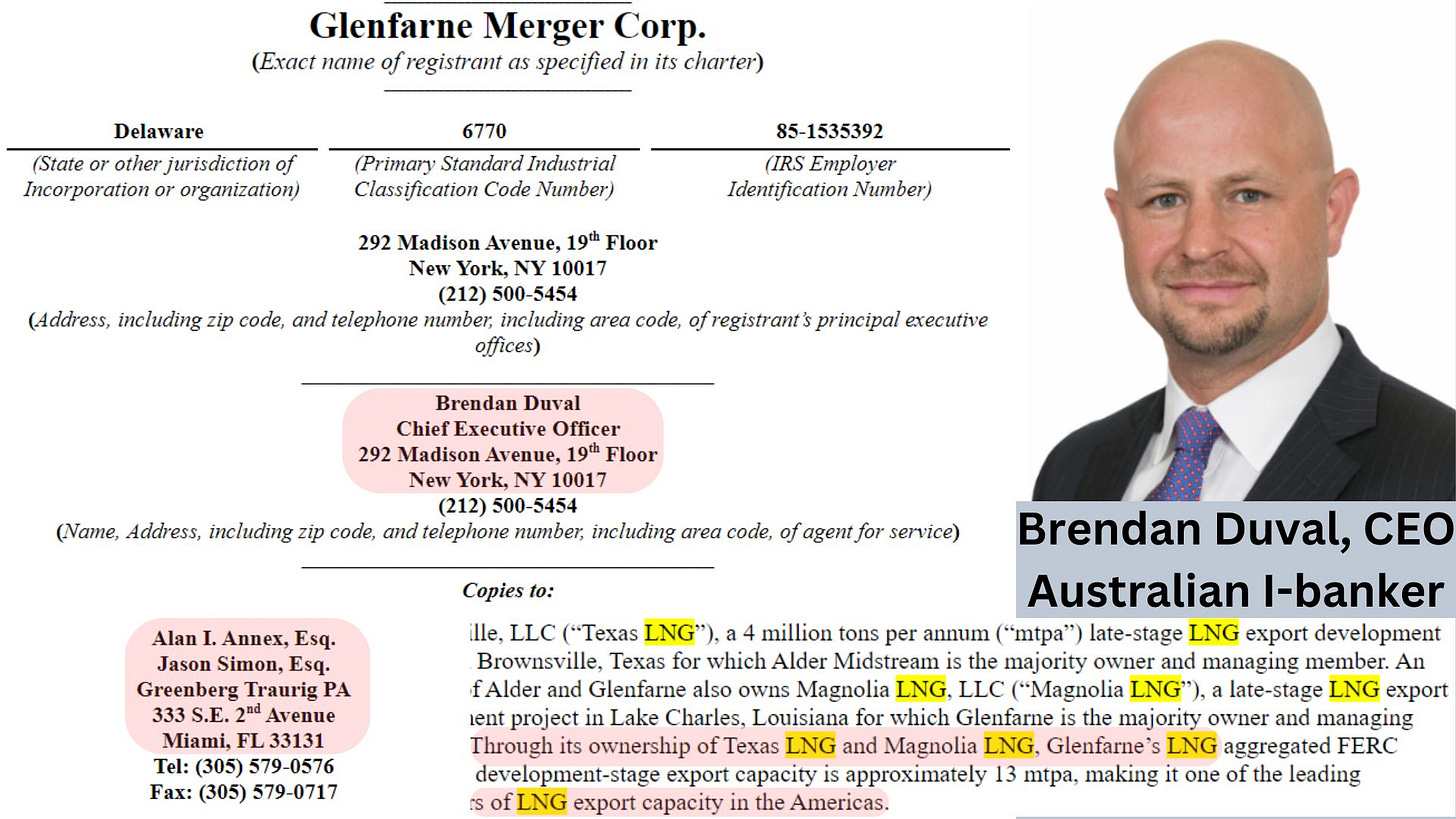

Glenfarne Group SPAC

SPACs were hot in 2021 just as new owner of Magnolia and Texas LNG, Glenfarne Group, entered into the foray of SPACs with its IPO (initial public offering) pitched on August 5, 2020 from their SEC filings. Their IPO kicked off on Feb 17, 2021, citing that various entities would house the money:

“Proceeds we receive from this offering…will be deposited into a segregated trust account located in the United States at J.P. Morgan Chase Bank, N.A. and ___, with Continental Stock Transfer & Trust Company, acting as trustee, and $2,000,000 will be available to pay fees and expenses in connection with the closing of this offering and for working capital.”

Glenfarne’s Legal Matters heading noted that:

“Greenberg Traurig PA, Miami, Florida will pass upon the validity of the securities offered in this prospectus with respect to units and warrants.”

These are important because:

controlling trust entity for money received (JP Morgan)

stock certificates/securities housing (Continental)

the law firm & geographic location where Glenfarne’s SPONSOR LLC Power of Attorney is located. (Miami, Florida - specifically, the Wells Fargo Center.)

Hunter Biden’s Wells Fargo account received a $1,000,000 payout from CEFC (through Cathay Bank) in late March 2018; and he often used his Wells’ account to pay “women.” In total, about $700,000 out of his $4.9M income over 5 years went to women like Gulnora Djamalitdinova. This was confirmed by IRS investigators.

The devil is in the details when doing investigations into the how something is occurring, or being “project managed.” Most people don’t want to hear about the minutia - though if you don’t provide every single aspect of the trail to their exacting specifications - they’ll also state: you’re just a conspiracy theorist.

One though has fleshed out this LNG export ownership trail in a manner that would likely make James B. Stewart, the Pulitzer Prize winning author for Den of Thieves (starring Mike Milken and others) blush. It is that complex - and likely, hard to follow in one big gulp from the financial SEC/SPAC firehose. The facilitators here are numerous; and started this LNG acquisition project in late 2015 - and certainly - no later than Hunter’s arrival in Miami on Valentine’s Day 2017 when Hunter acquired a diamond from Chairman Ye.

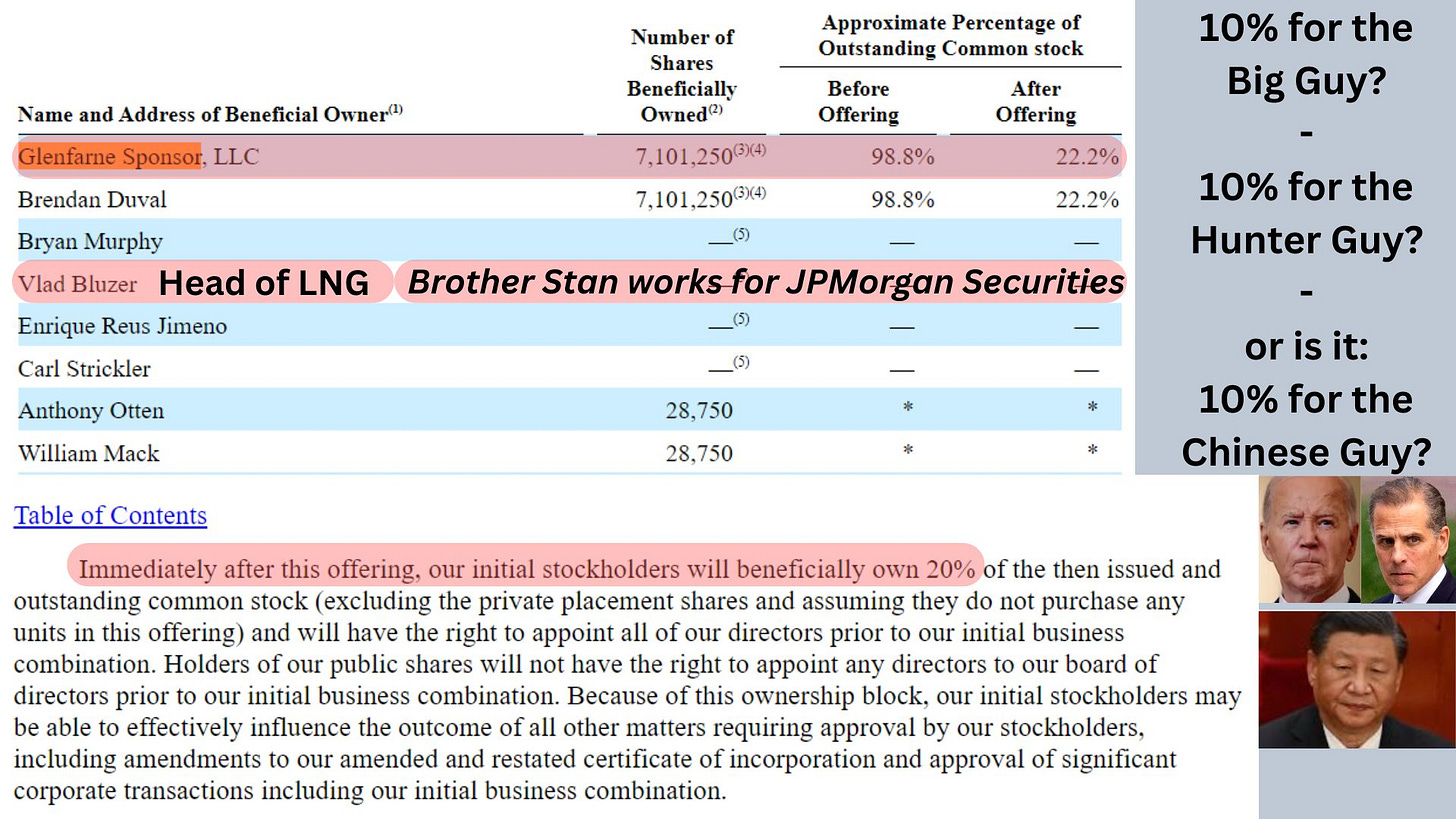

This LNG deal below is at least $70,000,000+ of direct ownership by the Glenfarne Sponsor LLC; AND potentially, ownership through cutout entities for this SPAC, pushing the total into the 9-figure payday category.

This would represent the Bidens nest egg off U.S. LNG ownership by proxy. Or is it: a shared collaboration with the China’s Paramount Leader?

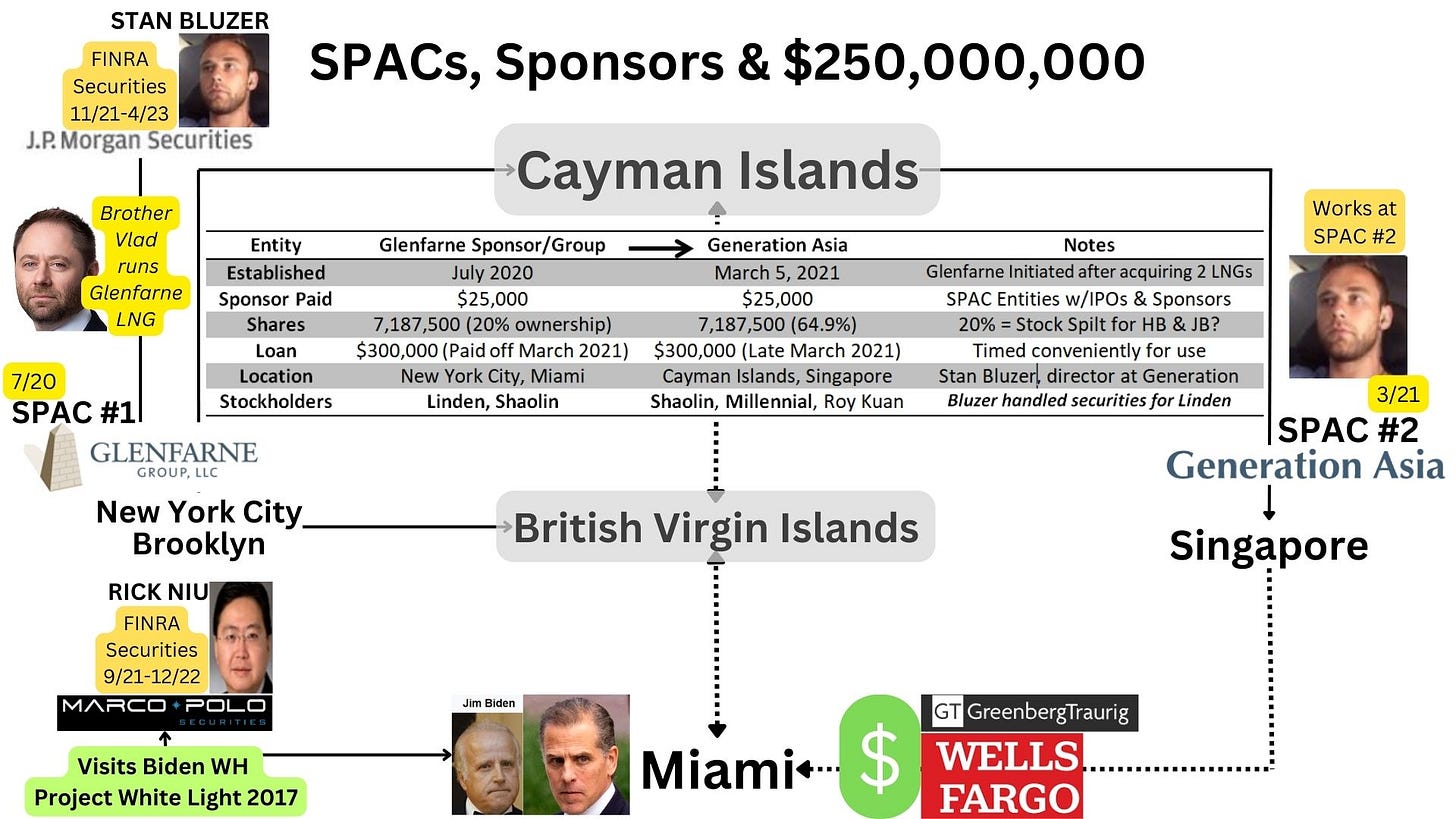

Securities & SPACs: Xiaopeng ‘Rick’ Niu & Stan Bluzer

Starr Insurance top Chinese advocate and Hunter Biden’s “friend”, Rick Niu, it is one’s contention, has stayed heavily involved with the Bidens and their LNG nest egg management. The former is easily confirmed by his numerous visits to the White House to visit with Sarah Donilon and Kurt Campbell, among others highly placed in the National Security apparatus.

Niu is a top-tier CCP-connected player that no one dare speak of. Even as his connections to highest level of U.S. intelligence (Petraeus, Woolsey (by proxy)), and to the Chinese, direct line to Beijing, is concerning if you care at all who is manipulating U.S. Energy or National Security policy.

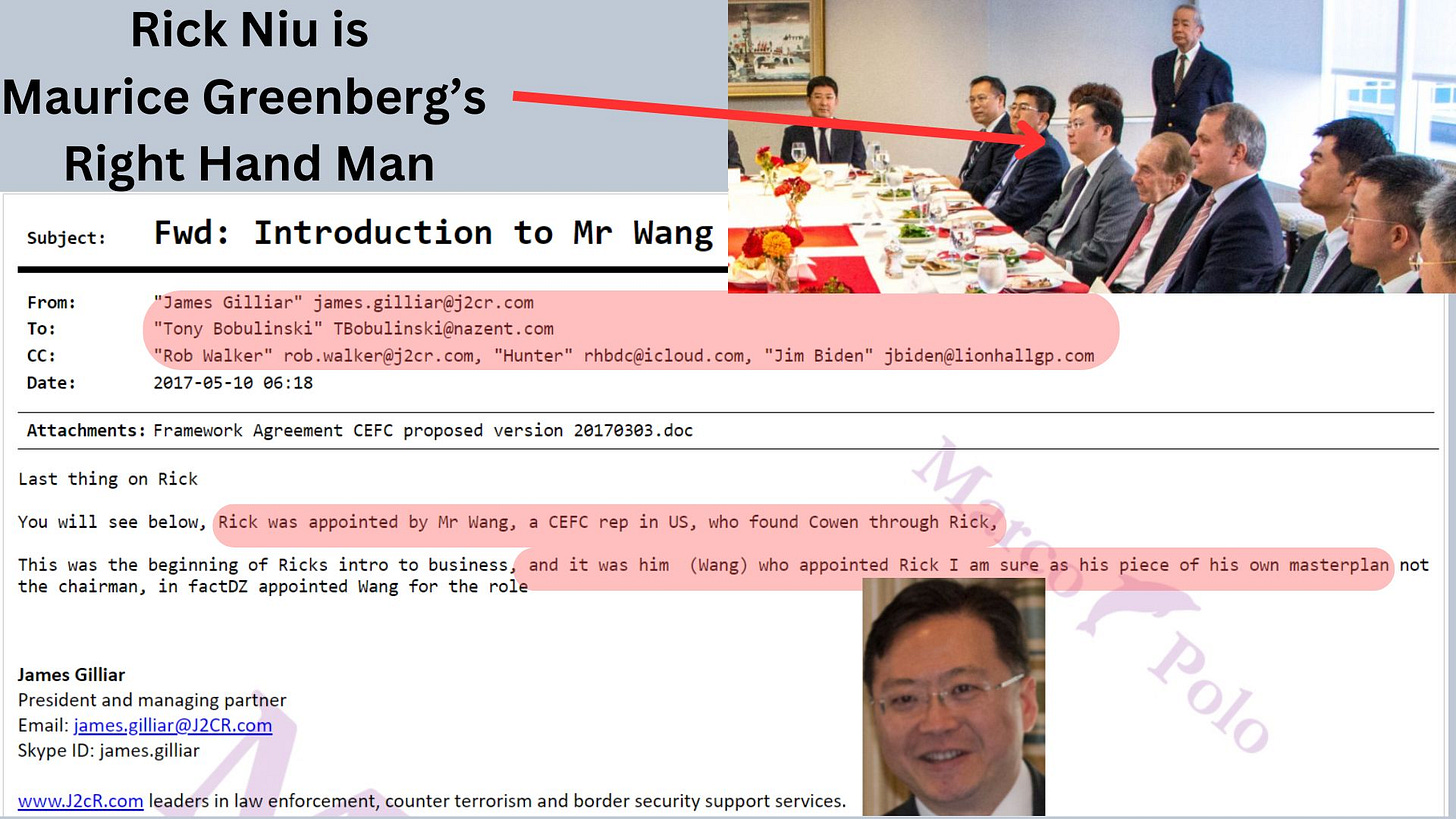

(Cowen, a deal cited below, was formerly ran by Peter A Cohen, of RJR Nabisco 1980s leverage buyout acclaim. Cohen lost to KKR in the acquisition of behemoth RJR. Rick Niu facilitated the Cowen DEAL, noting this in a Project White Light email that lectures Hunter Biden’s former sidekicks.)

Rick is no fool. He knows everything about the Bidens, and then some, one suspects. His two decade plus attachment to Maurice Greenberg of AIG fame (and infamy), has introduced him to all sorts of characters. Hunter Biden being at the bottom of that barrel, but with the right name, has him visiting the Biden White House over a half dozen times while he supported the Mike Pence PAC in 2020. (Supporting a traitor, eh?)

Rick Niu key connections to Glenfarne’s CEO Brendan Duval are:

Both live in Scarsdale, NY (just 1 mile from each other)

Both work in mid-town Manhattan (as do both their wives)

Rick Niu’s office was on the exact same floor as Magnolia LNG former financier. (First Wall Street Capital’s CEO is Glenn Myles. Myles is a Mike Milken and Bill Clinton buddy, and also: a Facebook Friend of Rick Niu and served as a senior advisor to CV Starr (also tied to Niu). Myles also LinkedIn-endorsed Devon Archer. If you recall, that is Hunter Biden’s investment buddy and board member at Burisma (April 2014).)

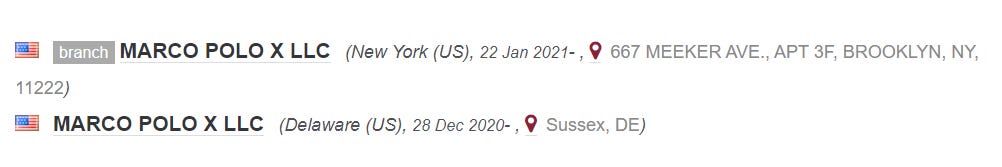

Niu is attached to Marco Polo Securities according to FINRA filings.

Marco Polo Exchange LLC is the owner of Marco Polo Securities (MPS). MPS has a partnership agreement with Paradigm Capital International that has 2 partnerships in real estate (Royal Palm Companies, Participant Capital) that are both housed inside the Wells Fargo Center where Greenberg & Traurig manages Glenfarne’s Sponsor via POA.

Also notable: Devon Archer reflected that Greenberg & Traurig represented Rosemont Realty (Hunter may still own interest/shares of this Chinese-acquired entity.)

New York state shows a Marco Polo X LLC was created as a foreign liability company and is located in Brooklyn. The Marco Polo parent LLC was created 3 days after Christmas 2020. The NY foreign entity occurred sometime between 1/22/21 and 2/17/21 (Glenfarne’s IPO SEC filing).

Stan Bluzer, brother of Vlad Bluzer (head of LNG for Glenfarne), had his FINRA held with JP Morgan Securities. He lives 2 blocks from the oddly located apartment of Marco Polo X LLC at 667 Meeker Ave in Brooklyn.

Stan Bluzer, is now a director at Generation Management, consisting of 6-10 employees. Generation Management operates a $250M IPO-SPAC called Generation Asia. This entity, launched on March 19, 2021, right after Glenfarne’s IPO, has the exact same stock share allocation for its Sponsor ownership, loan structure, and similar top stockholders as Glenfarne Group’s IPO.

Generation Asia recently relocated to Singapore (November 2023) to the same office building that houses: Glenfarne’s financier for their subsidiary EnfraGen LLC (Sumitomo), JP Morgan and Greenberg & Traurig offices. Glenfarne completed a deal with Gunvor Group out of Singapore. Other connections exist as well (Partner Group, Natixis, Starr, et. al.)

Generation Asia

This is gathered from SEC filings, LinkedIn, corporate websites, and articles. Marco Polo provided the emails to start this hunt on Hunter’s LNG forays.

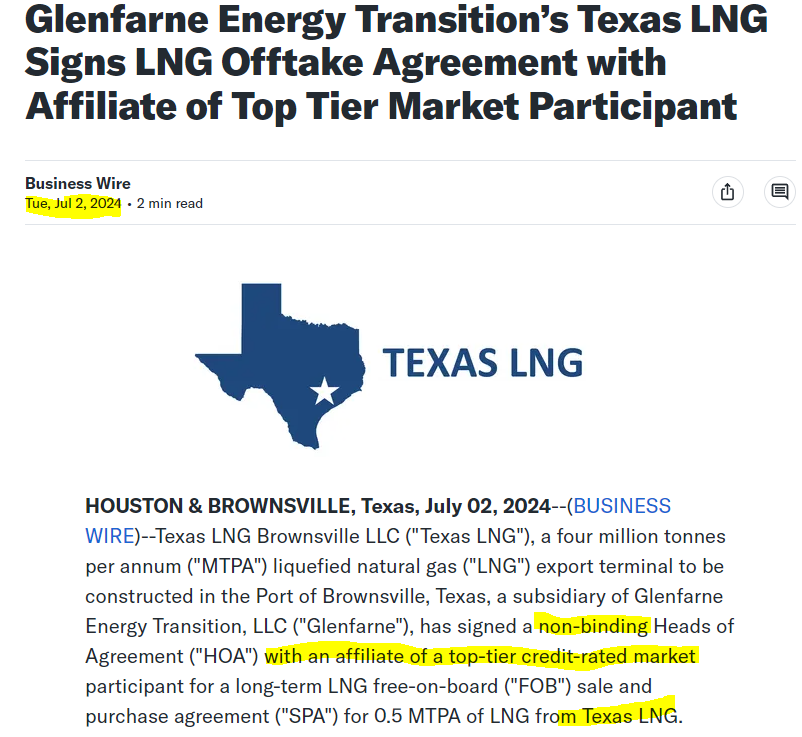

With the Bidens nearing the end of their stay in the White House (we hope), their grift has to be in place accordingly. Glenfarne is busy on Texas LNG. Texas LNG was connected to Hunter Biden through Third Point emails.