TD Bank Fires Personnel over anti-Money laundering. Backstory is needed.

The story is: which US entities & CCP involvement.

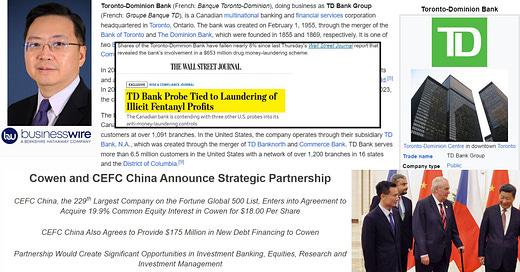

When news requires a short review of prior history, one should provide it. Toronto Dominion Bank made big news regarding their firing of leadership personnel over lax (meaning: none) application of anti-money laundering procedures to the tune of over half-billion dollars according to the DOJ. (A recent Gunvor commodities settlement overlaps with this story below.)

From the WSJ, the drug and money laundering was U.S.-based and of recent vintage:

[TD Bank] fired more than a dozen people for conduct issues related to failings in its anti-money-laundering program in the U.S., a person familiar with the matter said.

Since problems with TD’s processes to prevent money laundering came to light and the big Canadian lender entered the crosshairs of U.S. regulators and the Justice Department, it has launched an overhaul of the program and has moved to bring in new technologies and made a number of changes to anti-money-laundering leadership.

In an earlier WSJ story, these nuggets further the background tied to China and drugs and the laundering of the proceeds around the New York area:

The investigation was launched after agents uncovered an operation in New York and New Jersey that laundered hundreds of millions of dollars in proceeds from illicit narcotics through TD and other banks, according to court documents and people familiar with the matter. In that case and at least one other, prosecutors also allege the criminals bribed TD employees. [A Chinese case occurred in 2021.]

In a separate 2023 case, the U.S. Attorney’s Office in New Jersey charged Oscar Marcelo Nunez-Flores, an employee at a TD branch in Scotch Plains, with taking bribes and using his position to facilitate the laundering of millions of dollars in drug proceeds.

Did Cowen bring in the Fentanyl trade?

TD Bank acquired Cowen, Inc. in March 2023. As Bloomberg reported in July 2022:

A transaction would extend the reach of Toronto-Dominion’s investment banking arm, TD Securities, deeper into equity and debt offerings as well as research. Toronto-Dominion, one of Canada’s biggest lenders, has been aggressively looking to grow via acquisitions…

Cowen, which went public in 2006, saw its net income soar 38% year-over-year to $289 million in 2020 amid a record year for initial public offerings. In the past 12 months, it’s acted as a bookrunner on 55 IPOs, serving as the lead adviser on five of the listings, according to data compiled by Bloomberg.

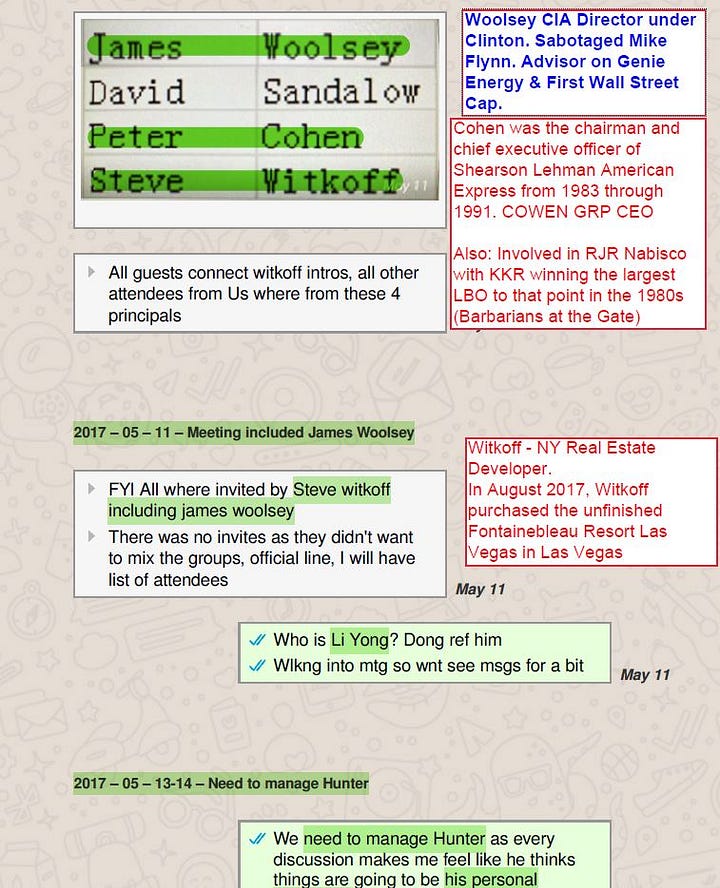

Cowen Inc. (NASDAQ: COWN) or (the Cowen Group in 2017) was then headed up by Wall Street icon Peter A. Cohen of RJR Nabisco fame. He was lead of the losing firm (Shearson-Lehman-Hutton) in the bid to pull off the largest leverage buyout deal in U.S. history (then $25 billion plus) to the winner KKR. This was memorialized in the book and the movie (starring James Garner) of the same title: Barbarians at the Gate.

Barbarians at the Gate (Full Movie - CUED UP to Peter Cohen entry)

Enter Xiaopeng “Rick” Niu

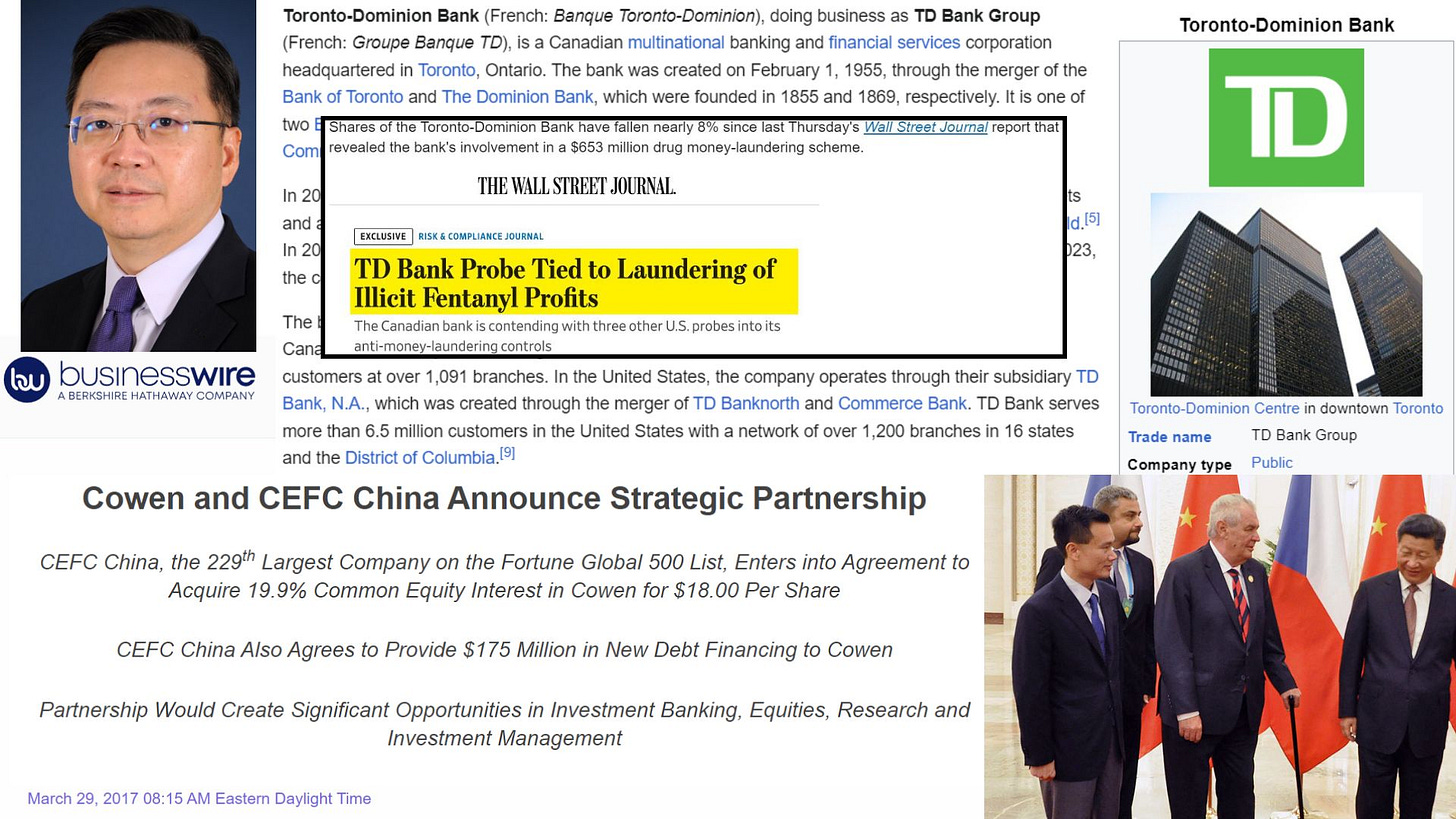

As it turns out, Cowen was hot and heavy with CEFC. CEFC, if one recalls, was operated by Chairman Ye Jianming, at the personal behest of Paramount Leader Xi Jinping, for the expansion of the One Belt One Road (OBOR) initiative. In early 2017, the Cowen-CEFC partnership was struck with Starr Strategic Partners, LLC, providing the financial advisory role to the deal between Cowen and CEFC.

Starr Strategic Partners, LLC served as financial advisor and Willkie Farr & Gallagher LLP served as legal counsel to Cowen Group.

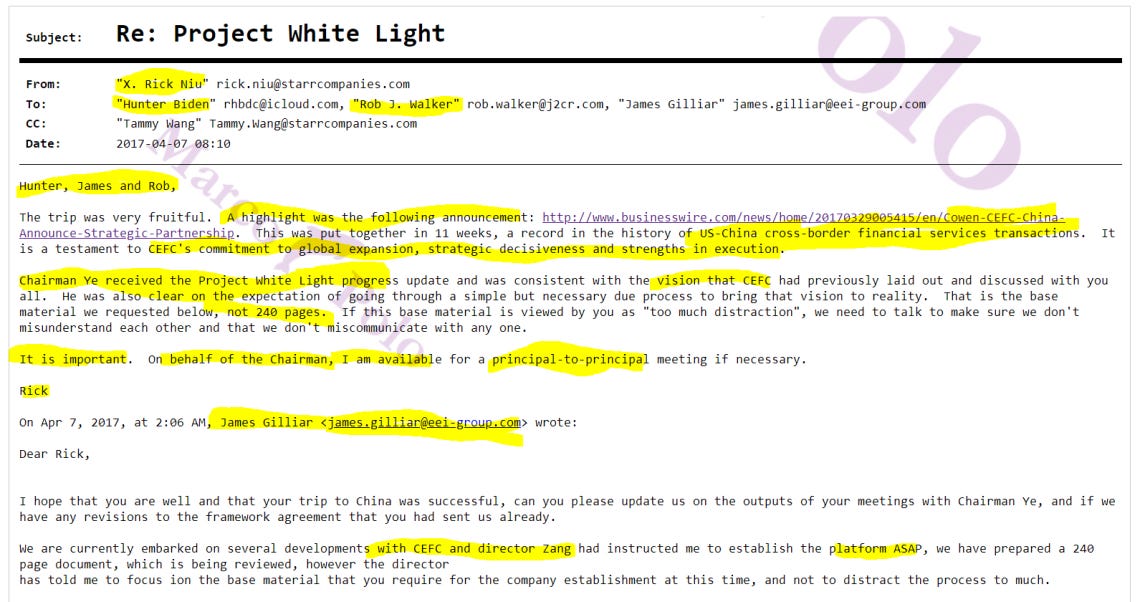

This is important because the President of Starr Strategic is none other than Xiaopeng “Rick” Niu. We have routinely discussed Rick’s role in Project White Light – as Hunter Biden’s burgeoning partnership with Chairmen Ye. Ye, who disappeared in March 2018 and hasn’t been seen since, provided millions of dollars that dropped into Hudson West III (HW3) bank account for Hunter’s immediate withdrawal. Hunter, Jim and Sara Biden garnered easy access to credit as Mandy Wong (a Chinese gal) provided the credit card issuance out of Cathay Bank in New York.

Source of snippets (Receipts) provided:

Rick Niu’s hidden, and key, facilitating role in Cowen partnering. He represented Cowen while deeply connected or operating for Beijing (Director Zang) and CEFC. Conflict of interest?

Rick’s FINRA attachment to Starr Strategic Partners

Hunter’s Wells Fargo bank statement (courtesy of Marco Polo)

Email with Mandy Wong providing credit cards to the Biden clan

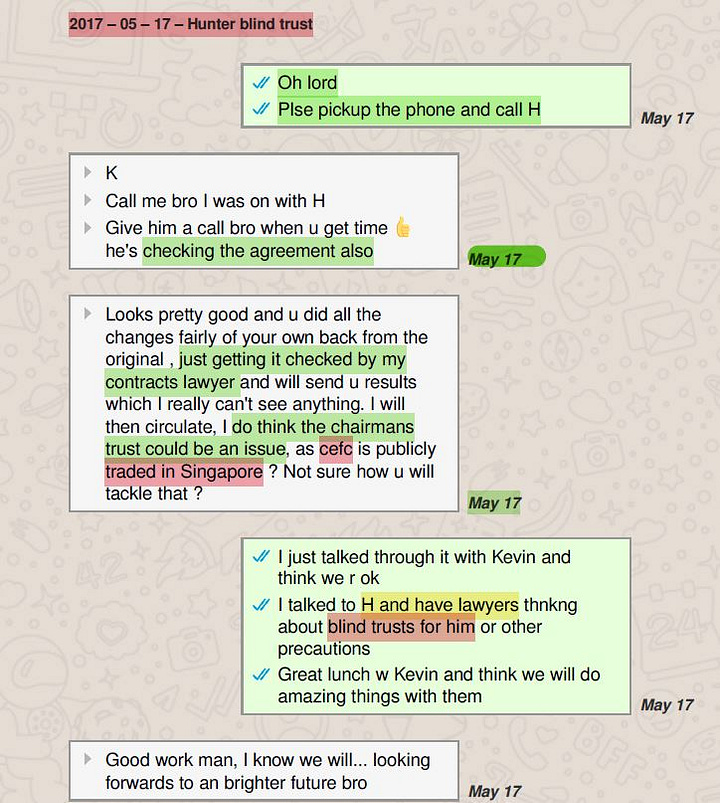

Notable: Tony Bobulinski’s text messages to James Gilliar mentions Peter Cohen

DOJ: money laundering crackdown or just a Biden cover story?

Recent news on money laundering from Biden’s DOJ just so happen to overlap with people that tie back to Hunter Biden in 2017. Gunvor Group did a partnership with Glenfarne Group - an entity heavily connected to Hunter Biden’s CEFC deal-seeking in the fall of 2017. The LNG projects - Magnolia & Texas are connected to Rick Niu as well. (Magnolia LNG was financed by First Wall Street Capital - located on the same floor and building that houses Starr and Rick Niu’s office.)

Gunvor Group Meet Glenfarne Group: Hunter Biden & Singaporean Connections

Starting in 2017, Hunter Biden’s deals moved from the friendly confines of Ukraine and Eastern Europe to more exotic and off-the-radar locales. A February 2017 Miami, Florida meeting with Chinese billionaire and CEO of CEFC Ye Jianming kick-offed the money (or diamond flow). This came after a

Rick’s friends at a recent SALT conference: anti-Trump brigade (with Milley, Esper, Scaramucci).