Japan-US Carry Trade: Finance 666 Graduate Course in under 10 minutes

Underlying causation to the Monday Bloodbath in the Casino Markets

Source: Meet Kevin (Trading Economics)

Zero Hedge Quantifying the Size of the Carry Trade: $20 Trillion

The reason: the $20 trillion carry trade that the government of Japan has been engaging in for the past 40 years has been one giant a ticking timebomb, one which can not be defused, and when it blows up, it's game over for the Bank of Japan.

Why? well, with the help of DB's chief FX strategist George Saravelos we explained why last December when we also quantified the total size of the trade whose blow up will demand a coordinated central bank rescue in the coming days (not surprisingly the world's central bankers have no idea what has happened and will be panicking after the fact as usual, and unleashing a historic flood of rate cuts in the coming weeks to stabilize the situation).

…

On one hand, if the Bank of Japan decides to tighten policy meaningfully, this trade will need to unwind. On the other, if the Bank of Japan drags its feet to keep the carry trade going, it will require higher and higher levels of financial repression but ultimately pose serious financial stability risks, including potentially a collapse in the yen.

As Saravelos puts it, "Either option will have huge welfare and distributional consequences for the Japanese population: if the carry trade unwinds, wealthier and older households will pay the price of higher inflation via rising real rates; if the BoJ delays, younger and poorer households will pay the price via a decline in future real incomes."

Which way this political economy question gets resolved will be key to understanding the policy outlook in Japan in coming years. Not only will it determine the direction of JPY but also Japan’s new inflation equilibrium. Ultimately, however, someone will have to pay the cost of inflation "success."

Success for the New World Order UNLOCKED.

Buffett Moves Markets on Margin Calls

Then there are a few things that we need to add to the list of worries and concerns:

Geopolitical Risk. We have been seeing a divergence between our estimate of geopolitical risk and the market perception of geopolitical risk. From Iran, to North Korea, to Russia, the market is suddenly catching up to us on the risk of escalation and expansion. [Add in the Ukraine still…]

Buffett sales. Certainly not something we pay close attention to, but announcements of Warren selling down certain positions doesn’t seem to have helped anything.

Life moves pretty fast.

From Zero Hedge Yen Carry Trade Article:

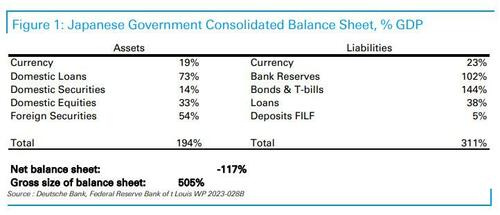

As Saravelos explains, at a gross balance sheet value of around 500% GDP or $20 trillion, the Japanese government's balance sheet is, simply put, one giant carry trade. It goes at the crux of why it has been able to sustain ever-growing levels of nominal debt. [My emphasis.]