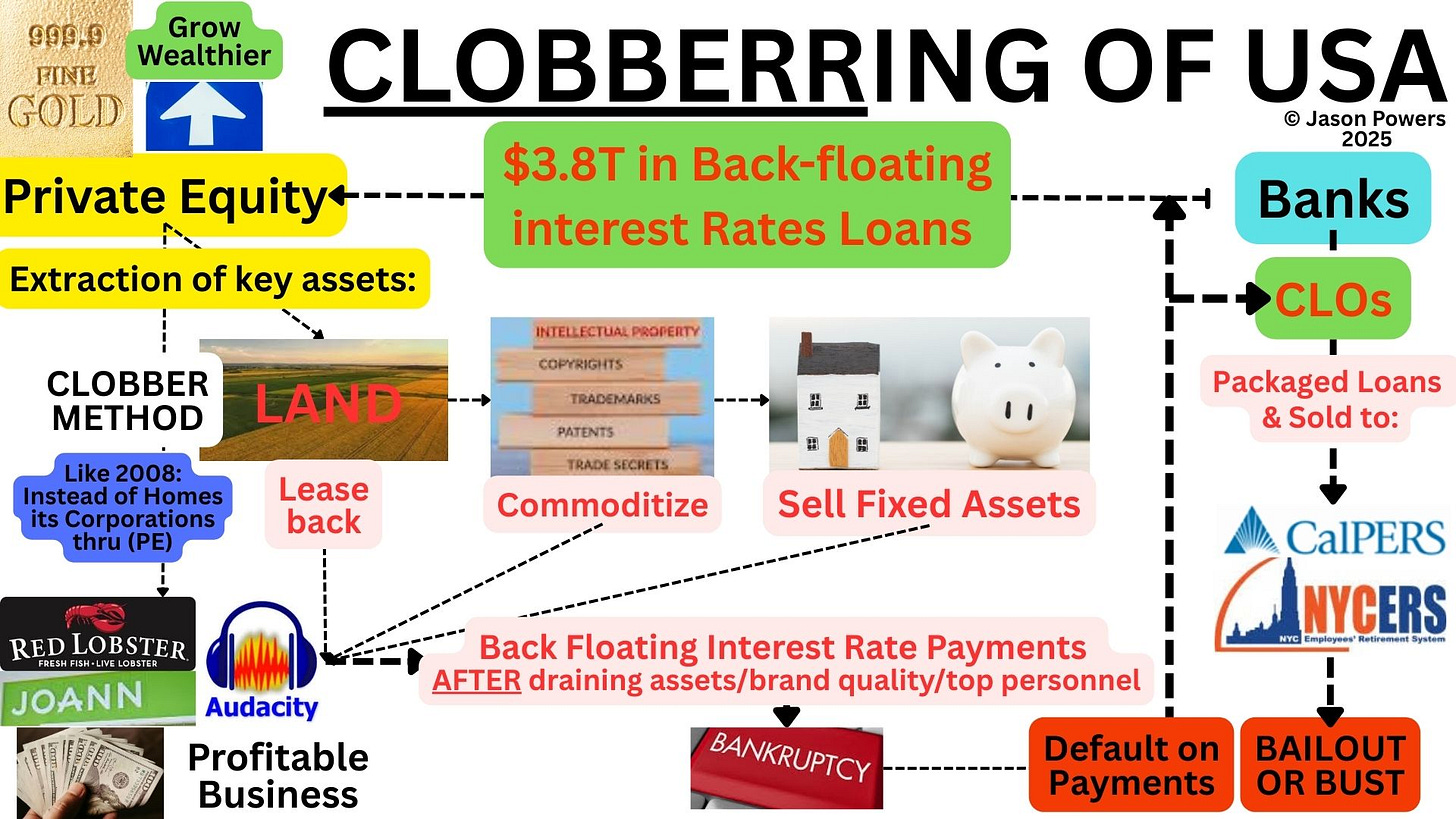

CLOBBER METHOD: Consumer Leverage Onerous Buyout Back-floating Extraction Rate-Rape

Nothing exists in the public lexicon without the accompanying terminology described.

Sources: https://x.com/ChanelRion/status/1915898014876491873

https://x.com/TheVinoMom (Below)

AI’s thoughts on LBOs (from Google)

https://tinyurl.com/LBOAIthoughts (as of 4/25/2025, 7:45EDT)

My additions to clarify the BS that AI generates in bullet points

Acquisition through Debt: The core of an LBO is the use of significant debt financing to acquire a company.

Private Equity Firms: LBOs are commonly initiated by private equity firms, which are specialized investment firms that manage pooled capital for investment in private companies.

Debt Financing: The PE firm secures debt financing from sources like banks, institutional investors, or the bond market.

Collateral: The assets of the target company often serve as collateral for the debt.

MY ADD: [These assets are routinely sold off - so the basis of the loan is no longer guaranteed by the underlying assets used to acquire the SAID LOAN. This is/or should be highly illegal. But since the Bankers and Private Equity have created a risk-free system TO THEM whereby: they SHIFT ALL the RISK to COMPANY (that PRIVATE EQUITY) acquired; and to the PENSION FUNDS ( thru BANK CLOs), neither is as concerned with this RISK taken. Just like 2008, the REWARDS are made upfront in fees and quick conversion of assets for PE & Bankers alike.]

Cash Flow Repayment: The debt is repaid through the cash flow generated by the acquired company.

MY ADD: [The company now FAILS due to the onerous conditions the PE company applies after creating more covenants [high leasing rates, reduced staff, brand shifts] to destruct a company’s operating capacity.]

Value Creation: The PE firm typically aims to improve the acquired company's performance and increase its value over time, often by implementing strategic changes, operational improvements, and cost reduction measures.

[AKA: TOTAL BULLSHIT. As stated above.]

Exit Strategy: The PE firm eventually sells the company (or a portion of it) to another investor or in an IPO, realizing a profit on their equity investment.

MY ADD: [Instead now, the COs are going to the wall: AKA Bankruptcy.]

Why LBOs are used:

Wealth extraction, reduction of competitors and monopoly growth

High Leverage: LBOs allow PE firms to acquire companies with a relatively small equity investment, using borrowed funds to magnify their potential returns.

Value Enhancement: PE firms have expertise in identifying and improving companies, leading to increased value and potential profits.

Exit Opportunities: The sale of the company, or part of it, provides a way for the PE firm to realize their investment and return capital to their investors.

Back-floating Rate Loans (Results?)

Medium Article to support claims made

In recent years, private equity firms have come under scrutiny for their role in the financial struggles of well-known businesses like Hooters, Joann’s, and others. What began as an investigation into the bankruptcy of these companies has revealed a much larger and more alarming issue: a $3.8 trillion bubble of adjustable-rate loans that threatens to destabilise the American economy and jeopardise the pension system….[My emphasis.]

In the case of Hooters and other businesses, private equity firms have taken this strategy a step further by using **adjustable-rate loans** (also referred to as “back-floating rate loans”). These loans have interest rates that fluctuate with market conditions, meaning that as interest rates rise — as they have consistently over the past three years — the cost of servicing the debt increases every 30 to 60 days. Even profitable companies like Joann’s, which reports 97% of its stores as profitable, are being driven into bankruptcy because they can no longer afford the escalating debt payments.

[My emphasis.]

From CEPR.Net

The Financial Times is reporting that private equity (PE) assets under management (AUM) declined 2 percent from 2023 to 2024 – the first time a decline occurred since 2005 when AUM was first tracked. The proximate cause was a $3 trillion backlog of aging and unsold assets, as PE firms struggled to unload companies acquired in the last decade. As a result, PE funds were unable to return cash to investors. Payouts have fallen to about half their historical average. Pension funds, the largest source of funding for PE buyouts, have been squeezed the most. They need to receive these payouts on a regular basis to fund their payments to retirees. [My emphasis.]